Tencia Debtors

The Tencia Debtors (Accounts Receivable) enables businesses to easily and quickly generate and send invoices, define credit terms, manage collections – and gain the liquidity to fund growth, shorten the credit-to-cash cycle and seize new investment opportunities as they arise. With real-time visibility throughout the entire AR process, finance teams can check the status of receivables anytime, at the macro level as well as down to each individual customer and invoice.

Automatically post order transactions to the General and Debtors Ledgers, with accurate tax calculations on each invoice, for rapid, precise tax processing and billing. Tencia automates manual accounts receivable processes and empowers finance teams to issue digital invoices and offer multiple payment options to speed collections.

The module feature allows you to keep track of important customer sales and credit information. Tencia gives you the ability to quickly and easily monitor customer outstanding balances. The simple-to-use interface lets you perform detailed on-screen inquiries providing you with up-to-date information to enable efficient customer follow-up and collection of outstanding amounts.

The Accounts Receivable module integrates with Cash Book, Creditors, Sales Orders, Stock, Job Costing, Fixed Assets, Counter Sales and General Ledger.

Module Features:

- Invoices may be set up for regular processing by groups.

- Automatic processing of invoices

- Customers are set up as a combination of types including; weekly, fortnightly, or monthly.

- Exception reporting.

- Consolidation of Customers into parent accounts when issuing statements.

- User interface screens are customisable to streamline data entry.

- Automatic calculation of settlement discounts where required.

- Flexible transaction inquiry screen where information about current and past transactions can be viewed and analysed.

- Allows for open item and balance forward customer accounts.

- Review up-to-date information such as current balance and transaction details for each customer account.

- Transactions can be posted to future periods.

- Apply dollar and credit limits to individual Debtors.

- Create new Customers on the fly when entering an invoice.

- Create an ageing Customer report on-screen and preview customer transactions.

- Ability to send statements and invoices to customer’s billing or email address.

- Create customised statements and invoices.

- Automatic notifications when debtors have exceeded their credit limits.

- Up to 100 user-defined fields on the Debtors Master file.

- Can put values on hold and alter pay dates.

- Multi-level dissection including sales code, area code, and customer type.

- Service and stock invoicing with unlimited text or stock images.

- Ability to calculate and generate invoices for interest charges on overdue accounts.

DEBTORS’ REPORTS INCLUDE:

- Summary trial balance.

- Detailed trial balance.

- Invoices.

- Credit Notes

- Statements.

- Debtor account ledger.

- Transaction/Tax listing, current and day book.

- Sales analysis by Customer, summary and detailed.

- Sales analysis by Customer this year vs last year

- Sales by sales codes, summary and detailed.

- Exception reporting.

- Name and address list

- Name and address labels.

- Unpaid Invoices List

- Sales Commission Report.

- Debtors Email Summary

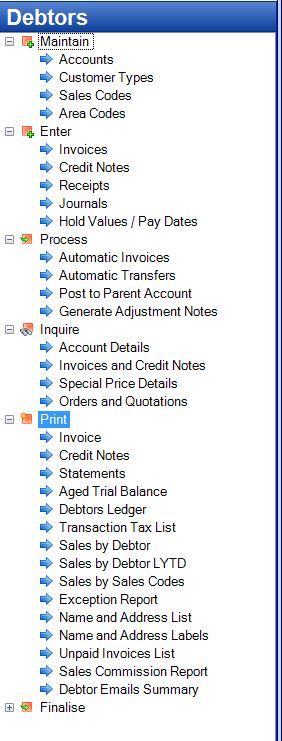

Accounts Receivable (Debtors) Menu