Fixed Assets

The Fixed Assets feature easily maintains accurate and timely balances on assets calculating both book and tax values. This gives you a complete movement and history of assets including depreciation calculations, reevaluations, disposals and asset transfers.

Fixed assets feature includes:

- Assets can be categorized by asset type and location.

- Maintain both book and tax value for assets.

- Ability to create new assets from existing asset details.

- Perform diminishing, straight line or prime cost depreciations.

- Flexible depreciation calculations including calculations, and frequency such as, daily, monthly, quarterly, six monthly and yearly.

- Revalue or write-off assets.

- Partly or totally transfer assets.

- Purchase of new assets can either be entered via Purchase Orders, Creditors or directly entered via the Fixed Assets module.

- A private usage percentage can be entered for each asset.

- Asset Pooling

- Multiple general ledger posting accounts based on asset type and location.

- Depreciation processing can be selected by asset code, asset type or asset location.

Fixed asset reports include:

- Fixed Assets details.

- Fixed Assets ledger.

- Transaction list.

- Depreciation schedule.

- Movement report.

- Deferred tax list.

- Private usage report.

- Maintenance due report.

- Insurance report.

- Exception report.

- Stocktake report.

- Fixed asset labels.

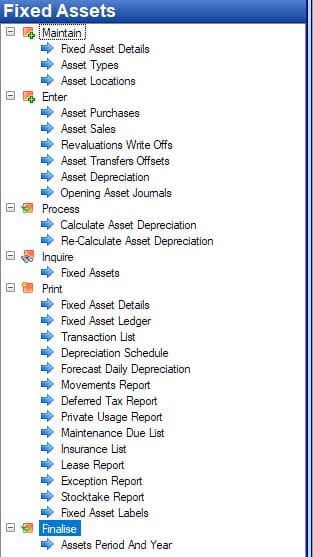

Fixed Assets Menu

Schedule a demonstration now

.